The Philippine Council for Agriculture, Aquatic and Natural Resources Research and Development of the Department of Science and Technology (DOST-PCAARRD) partnered with the Bureau of Internal Revenue (BIR) National Office to conduct a seminar on BIR registration and compliance for individual and group agricultural producers as a necessary step towards institutional market linkaging. It was held on June 11, 2024 at the Elvira O. Tan Hall, DOST-PCAARRD, Los Baños, Laguna and online through a video conferencing platform.

This initiative is part of the market-related services of DOST-PCAARRD’s Agri-Aqua Business Hub (AABH), particularly in supporting and facilitating the linkage of smallholder farmers with institutional buyers. Moreover, the activity aimed to address the lack of BIR-authorized invoices of smallholder farmers, which is one of the major challenges of farmers when transacting with institutional markets. This hinders them from accessing and transacting with bigger markets.

BIR-registration and compliance have remained a challenge for many smallholder farmers who are often overwhelmed by various rules and regulations that often deter them from complying with the necessary requirements.

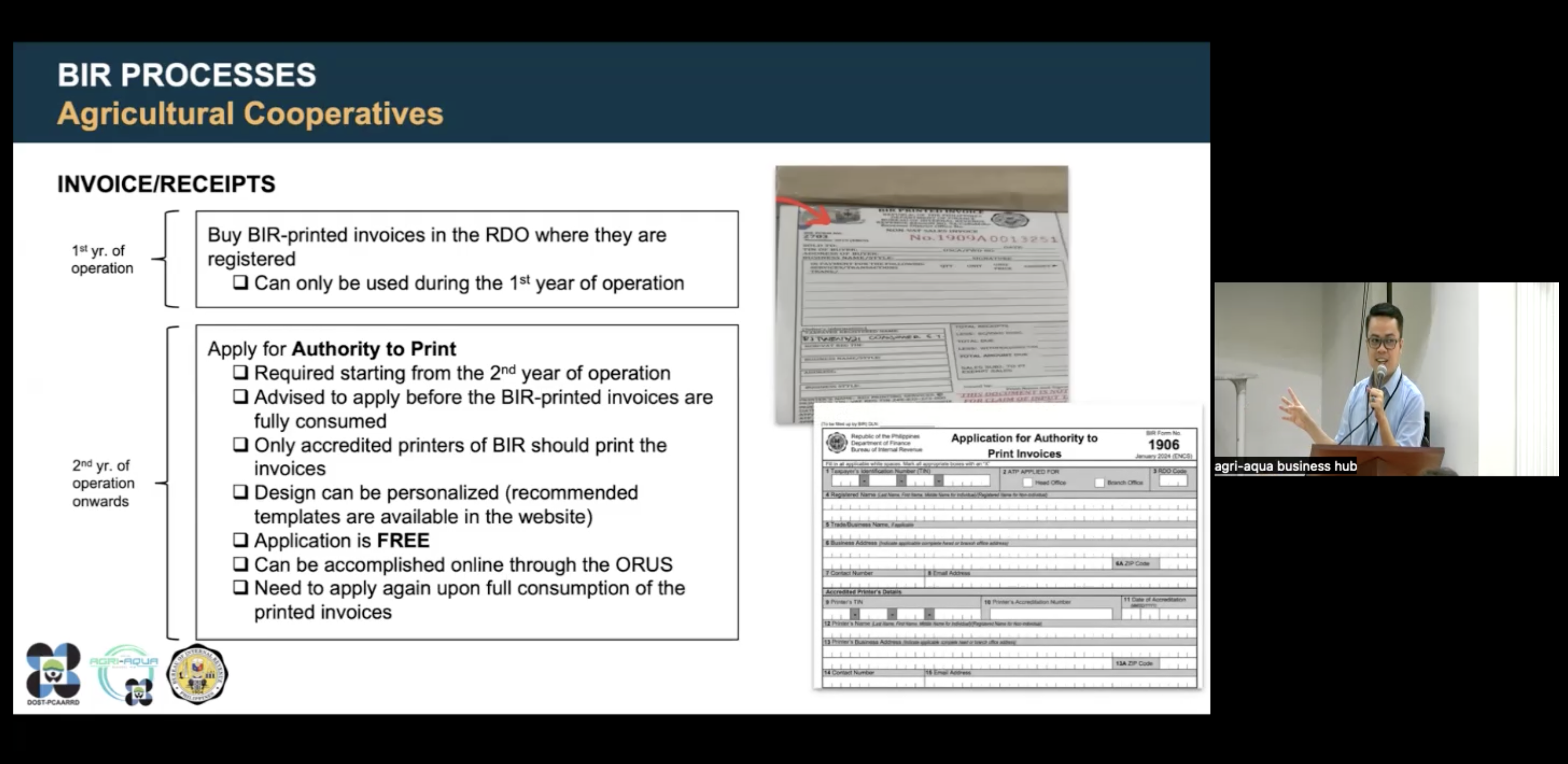

Through collaboration with the BIR National Office, the seminar informed the participants about the processes related to BIR registration and compliance, particularly on BIR registration, tax exemption and filing, bookkeeping, and invoice issuance for both individual and group agricultural producers.

The activity was attended by the AABH-supported farmer groups, key partner project implementers, and representatives from the DOST-PCAARRD Technology Transfer and Promotion Division (TTPD), including its key partners from different technology transfer and promotion projects.

Among the key partners who participated in the event were representatives from the Local Government Unit of Los Baños and Majayjay, Laguna; enterprise development project implementers from the University of the Philippines Los Baños (UPLB), DOST-Forest Products Research and Development Institute (FPRDI), Sorsogon State University (SorSU), and Pampanga State Agricultural University (PSAU), University of Philippines Mindanao (UPM); as well as technology transfer and promotion project implementers from Bohol Island State University (BISU); Mindanao State University at Naawan (MSU-Naawan); Caraga State University (CarSU); University of Southeastern Philippines (USeP); Davao del Sur State College (DSSC); Sultan Kudarat State University (SKSU); Bulacan Agricultural State College (BASC); Sorsogon State University (SorSU), and Samar State University (SSU). These agencies could serve as DOST-PCAARRD’s partners in disseminating the information from the seminar to the agricultural producers.

The seminar discussed the basic compliance requirements for business taxpayers, modes of registration with the BIR, and BIR processes for individuals, associations, and cooperative agricultural producers. Mr. Gibson D. Sta. Maria, Chief of the Registration Processes Review Section under the Taxpayer Service Programs and Monitoring Division of the BIR National Office, served as the speaker for these topics.

During the open forum, Mr. Sta Maria answered questions and clarifications about registration, invoice issuance, and penalties for late/ and no filing, among others, from both the live and online participants.

Prior to the seminar, the AABH conducted a Key Informant Interview with BIR Officials – Assistant Commissioner Janette R. Cruz of Client Support Service and Assistant Commissioner Larry M. Barcelo of Legal Service– to understand the processes involved in exempting smallholder individual agricultural producers from the issuance of invoices as well as other processes involved related to BIR compliance for agricultural producers. This laid the groundwork for the conduct of the seminar. It served as a results-cascading activity for DOST-PCAARRD-supported farmers and project implementers, who also provided assistance to farmer-groups.

As part of AABH’s continuous effort to disseminate information and raise agricultural producers’ awareness of BIR processes, information materials such as leaflets/brochures and Frequently Asked Questions (FAQs) will be developed. Moreover, as AABH’s way forward for this initiative, conducting a series of identical seminars in different regions to accommodate a wider audience and incorporating similar topics in agribusiness-related capacity building activities are being considered.